Once in a lifetime moment for banks to digitally transform

I know it’s hard to be positive when the world faces its biggest challenge since World War II – and from an invisible enemy. The calamity is total – economic, health and social. I suspect the challenge will continue for the next 60 days till a workable solution is found. However, I am a firm believer that a positive mind means a positive body and better immunity, so irrespective of whether this article adds value to your business, I at least hope that for next 30 minutes, it helps you to think positively.

That being said, we need to start with the reality. The banks are facing, and will face challenges in the coming days, and, therefore, understanding those challenges is very important. One needs to understand the challenges so that a solution can be found, especially from a technology standpoint.

The Challenges

Before I go through the list of challenges, it’s important to remember that the intensity of the challenge will depend upon where the bank is based, and whether it’s a Tier 1 bank or a Tier 2 banks (e.g. community/emerging). So please calibrate as you feel appropriate to ensure you identify the right, not the wrong challenges.

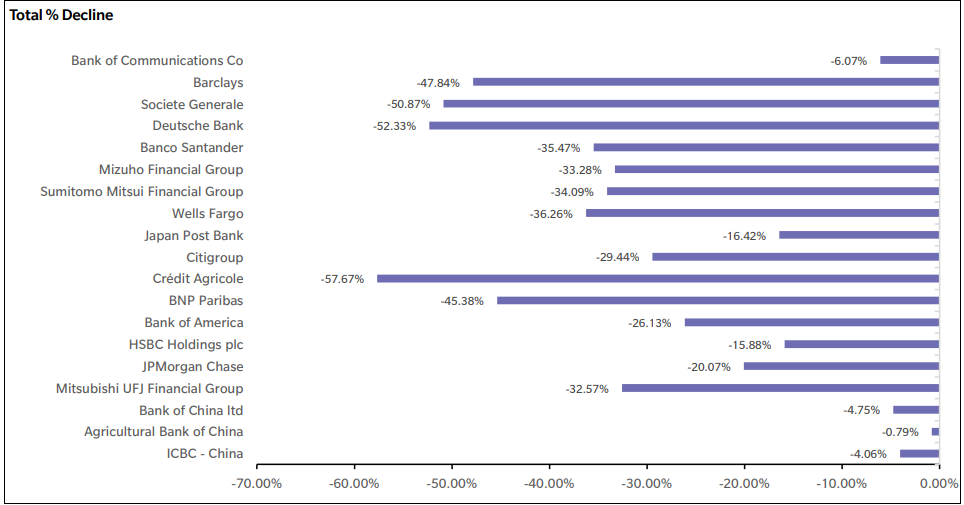

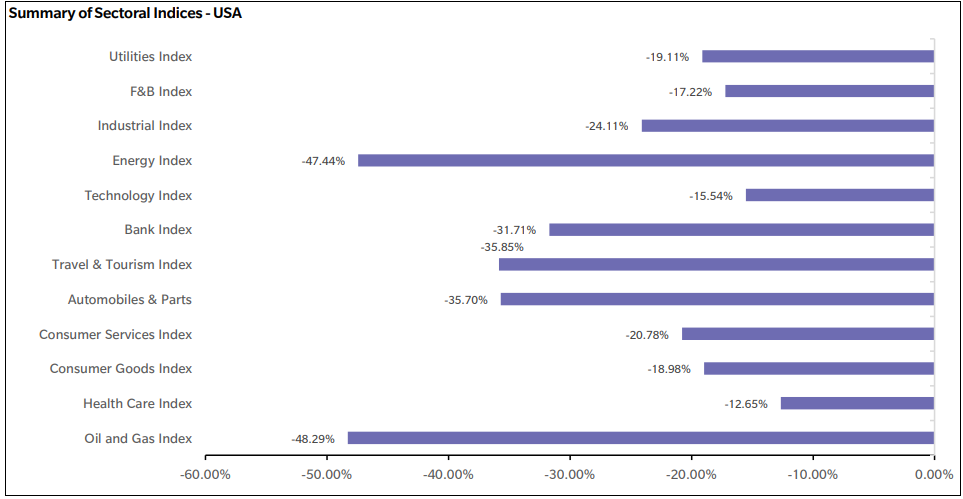

1. Financial Services sector stability & profitability comes under pressure – stock valuations and prices come down.

By the time you read this article, you really don’t need me to say this to you. All major stock indices are seriously off, and therefore all the underlying stocks. There are limited sectors of an economy that won’t struggle – maybe pharma/medical devices, and possible select technology firms. You also have to add to the problem the collapse in oil prices. Then, on top of that, you have lockdowns of cities and countries. So, nothing short of a blood bath across sectors! The good news in all of this (really) is that banking tech stocks have not done as badly as bank stocks.

2. Central banks reduce interest rates – if a significant part of the asset book is flexible rate, then interest margins are affected.

The US Federal Reserve has taken the interest rate to near zero. I thought only the Japanese used to do things like this to keep their economy from going into a permanent recession. In any case the world’s central banks have no choice so they have done it. However, remember that reducing interest rates never ensures increasing demand. Demand stimulus also requires the perception of things being positive, and, at this time, that’s impossible. The additional problem is that a drop in interest rates can also result in lower net interest margins for loans that are flexible rate loans.

3. Significantly lower business and consumer transactions – lower fee income.

This is a killer. With so many businesses in lockdown, transactions are at zero or near zero, so where is the question of fee income? There will be some peaking of online transactions as people stock up or continue to order online but branch transaction fee income will be off.

4. Less liquidity from governments as they need to finance deficits. And deferred spend – negative liquidity impact.

With all the stimulus packages, there is only two ways a government can support it – print more money or then use cash reserves they have to finance. Both will happen. The implication of this is that if I am a bank that is significantly dependent on government deposits (say, government owned or supported banks), then I will see deposits erode. If deposits erode, capital adequacy will get hit. This happened in India in mid-March with a privately owned bank where local state government pulled 3% of the deposits, resulting in the stock value of the bank coming down drastically. Governments really need to be careful here.

5. Number of corporate banking sectors negatively affected – oil & gas, consumer durable, automotive & more. Increased number of work out accounts, more NPAs, and reduced income.

This is really a big one. I went through a list of 12 key sectors, and 58 sub-sectors of the economy of a single country and I struggled to find even 3 sectors that could take advantage of the situation – medical devices/pharma/healthcare, and IT services were two that stood out as positive.

6. SME/Commercial clients under pressure for many sectors – reduced demand and delayed payments from customers. Larger number of NPAs, work out accounts, reduced income, and a smaller trade finance book.

The situation is even harder for commercial and SME clients. They will face delayed payments from their clients, and reduced demand. A real sandwich. This is unfortunate as they account for almost 60% of labour employment is most countries.

Also, smaller banks rely on SME/commercial businesses – 60% of US small business loans come from community banks. This is really not good for smaller banks.

7. Wealth Management not so wealthy anymore – portfolio values down. AUM down.

A lot of private banking and wealth management clients will have seen their portfolios shrink drastically. Some 70%+ of the assets under management will be in equities. So AUM’s are hit, fee income hit, and clients will ask to move a lot of what is left into cash. Also limited fee income as fewer transactions. The scary part is margin calls would have come in in large numbers. Not a pleasant situation at all.

8. Retail book stressed – less liquidity, and asset quality under threat. Mortgage book impacted. Reduced spends on cards, auto and personal loans. Loss of personal income also resulting in higher NPAs. Limited retail growth.

This is a big one. Many banks have a retail book that is 50% of their asset book. Often retail also finances the commercial/corporate book from a liquidity standpoint. No income or job losses means less deposits. Less income means more of the loans (cards, PL) and maybe auto risk becoming NPA. This number could double. I am also concerned about retail and commercial mortgages. If the value of the asset is down even 10%, clients may be asked to top up if they don’t have enough equity in the loan, and many won’t be able to do that.

9. Branch utilisation drops off – fear of visit, fewer transactions.

Nobody wants to visit a branch – they are too scared of getting sick, or simply have nothing to transact. Even ATM usage will come off. This really impacts urban centres where Tier 1 banks were using high density cluster models with a lot of branches to maximise penetration in high potential areas.

10. The full revenue & cost model is affected – urgent need to transform, including job losses.

I guess in the end, it means the full revenue and cost model is toasted. Doesn’t matter whether you are a Tier 1 or Tier 2 bank, and whether you sit in New York or Mumbai or Cedar Rapids, Iowa. It’s not going to be business as usual – not for the near to mid-term!

In this blood bath, is there a potential winner? Digital channels and digital banking? Read on!

The Fixes

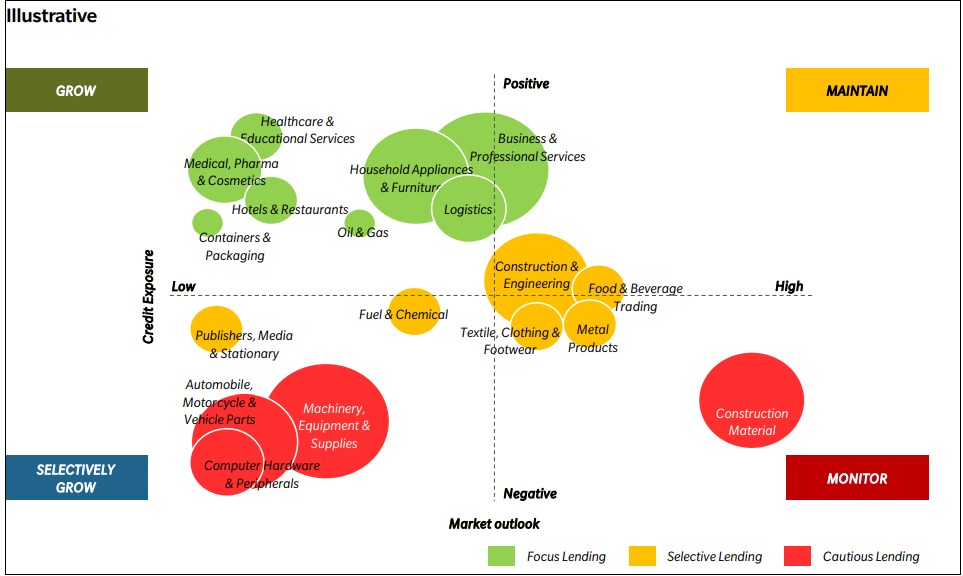

1. Immediately reassess sector macros & micros and identify sectors that have become short-term unattractive, those that are now positive, and map your clients and portfolio to the new reality.

We must start at the macro level. Every central bank breaks an economy up into sectors, and potentially sub-sectors. Each of these contributes to GDP at different levels. In most cases bank lending is directly proportional to the GDP contribution of the sector – or in many cases it should be. You will have to look at the sectors and classify them as most impacted, impacted, somewhat impacted, and not impacted.

This is not going to look like the chart you had 2 months ago. You will then have to overlay your existing asset book on top of this chart and see where you are going to get hit the most e.g. retail and hospitality. If 20% of your asset book is retail and hospitality and that section is hit by 30%... you can run the math. Aggregate it at a bank-wide level to see what the cumulative impact is.

2. Segment clients as per new sector matrix, and identify clients already troubled in risk sectors and those likely to be affected.

Then look at your client list for the most impacted sectors and build the list quickly. Anybody close to operating at limit utilisation levels is under threat of going under. Any accounts that are large exposure make the shortlist. Any accounts that are multi-sector businesses will be hit. And, naturally, the SMEs.

3. Allocate the above group to an expanded & high-quality work-out team to co-manage the clients with existing RMs and provide short-term business guidance.

Don’t necessarily do a drawn-down. In fact, provide additional short-term capital if needed. Refocus corporate RM teams to account monitoring, rather than new account acquisition for next 30-60 days.

I would not release corporate RM headcount at this time. If you drop your new account acquisition targets for RMs, you will have about 30% spare capacity of corporate bankers. Just let them focus on existing accounts, and immediately work with them to identify the 2-4 accounts with each of them that need to be co-managed by the work-out team.

4. Do all of the above for SME/commercial accounts at a higher level of aggression.

These are going to be very large numbers, and if it is not carefully handled, the damage can be as big as a large account going bust. Again, understand the industry they work in. The supply chain is very important. For example, if it is a packaging company supplying to both consumer products and F&B, the impact on their customers in both sectors could be different. In the early days I would recommend sending a detailed update form to all SME customers as I am convinced that account profile data will not be fully updated as the number of accounts is large. The biggest opportunity here is to get transaction banking going for both the SME and corporate clients. I will discuss this in detail below.

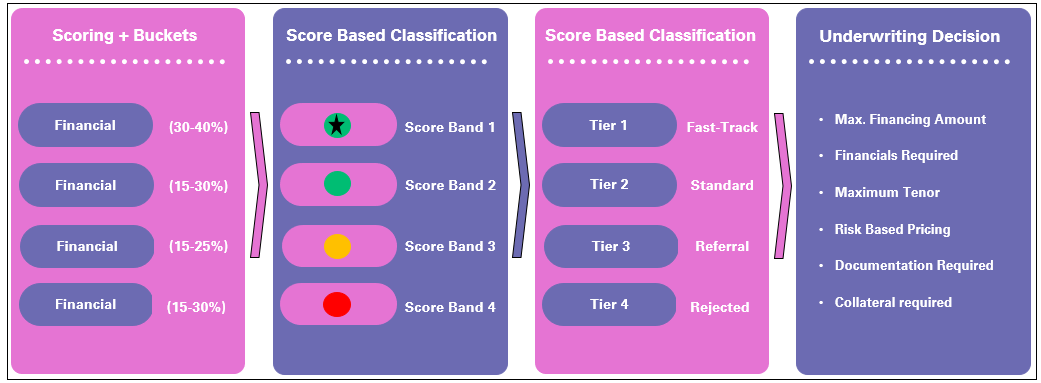

5. Significantly strengthen your risk, especially credit risk teams, and immediately redo credit scorecards and algorithms.

The old scorecards and their weightages are not valid anymore. Toss them out. New ones need to be built, going back to the sector and client analysis I talked about at the start of this section. The real issue here is that credit’s biggest role is when accounts are being acquired. Once the account is acquired, credit really only focuses on the exceptions – account or transaction exceptions – say 15% of the volume. The rest of the time is credit admin. But what happens when 80% of the accounts and transactions become exceptions, and credit focus now is about existing accounts, not the creditworthiness of new potential accounts. This implies volumes change, role changes, and competence changes. The whole credit function needs transformation, not just the scorecards. The team temporarily will need to be augmented by senior corporate and commercial bankers.

6. Protect your liability book.

Strengthen the size of the corporate liabilities unit (CLU). Banks structure the unit in different ways – some sit within the corporate bank, and some outside it. In my view corporate liability opportunities are never fully leveraged. Assets are always valued more. Double the size of the CLU team. Also, look again at your retail liability products and make them more attractive – the simple trick of a higher interest rate may work if you can lend at a higher rate. Pull wealth customers in as quickly as possible – a small group of wealth customers are equal to an ocean of mass retail customers. And finally, we are down to the final two end games that will make or break your bank.

7. Digital, Digital, Digital.

As I said at the start, this is a once in a lifetime opportunity. I remember in the early ‘80s when banks tried to push their customers to ATMs from the teller line, it took a huge effort. It’s hard to change customer behaviour, especially in older demographics. In the current situation most banks have done a decent job on the retail side, but not fully. Still 50%+ of front-end retail banking transactions are customer facing/in-the-branch, which is why there are still branches. This is the time to educate your older customers, who are in any case most impacted with the health scare, to transact from the safety of their home. However, to make that happen their UI/UX journeys will need to be simplified, and they will need more call centre support. For the younger group, simply incentivise and use gamification approaches that are already used effectively in the better-designed loyalty programs. And yes, strengthen your relevant bank-wide loyalty programs – at this time a cash back program, I assume, will do better than airline miles?

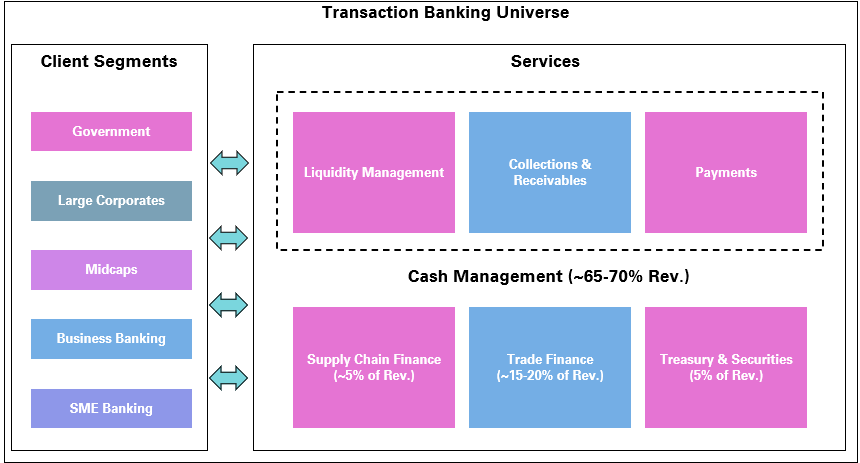

But the real opportunity is on the SME/Commercial and Corporate banking side – the digitization of the commercial bank or what is better known as transaction banking. Many banks have already started this journey. They need to accelerate it. To those that have not started it, I say: get going. This is it. If you don’t, there is a real likelihood of losing customers, or at least profitable parts of their business.

And, of course, your banking and technology infra will need to be enhanced ASAP. This is not about buying the next core banking system. This is making sure all your front-end digital assets are there (e.g. CRM). This is to make sure your cybersecurity assets are enhanced. Bottomline, any solution that helps with the digital bank, cloud, cybersecurity, RPA, AI will gain in these times. And lastly, of course FinTechs, especially payments. Before I close on this topic, may I say that the challenger/digital banks have a golden opportunity. Grab share while you can!

8. Bank Model & Cost Transformation

The end result of all of this is that the existing bank cost, operating model, and budget will no longer be viable. Think about it. Your account mix will need to change. Your credit scoring models will change. Your product mix will change. Your fee and interest income assumptions will change. Your channel mix will change. You will be materially more digital. Your branch network will have to change, and you will have to close branches. In a black swan event, yes, everything changes. Ever heard of zero-based budgeting? Well that’s what you need to do. You need to go back to the drawing board and build the business model from scratch. Then you need to move the model from where you are today to where you want to be – quickly.

As I said at start of this article, a black swan event can have huge negatives, but in every challenge, there is an opportunity. Stay positive and move forward. May the force and good health be with you.

To read more such insights from our leaders, subscribe to Cedar FinTech Monthly View