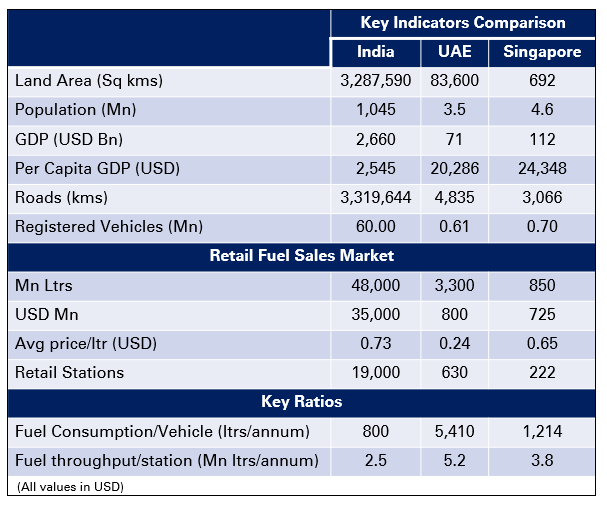

The petroleum retailing industry in Asia and Middle East faces significant challenges. With low product differentiation, lack of customer loyalty, coupled with intense competition, due to deregulation, as in India, the various players will try to gain share from each other. This will exert downward pressure on margins and force players to adopt new and innovative strategies.

India has deregulated the pricing mechanism for retail petroleum, enabling new players to enter the market, which was once a fiefdom of the public sector. The entry of new players like Reliance, will grow the number of stations from existing 19,000 to over 23,000-25,000 in next 4-5 years. This will reduce the average throughput per station, and total fuel volumes per player. With market determined pricing mechanism, prices will have to be lowered, thus reducing margins from fuel products.

In UAE prices are still regulated by the government. However, the current 3 players Adnoc Distribution, EPPCO, Emarat, tend to lose money on retail petrol, due to higher international crude prices. Also, by 2005 when GATT comes into force, the UAE market is likely to open up to further competition.

In Singapore, the 4 leading players Exxon Mobil, Shell, Caltex and BP, account for over 95% of the retail fuel sales. Singapore is challenged with limited geography for addition of new stations. With limited growth in number of vehicles, the retail fuel volumes will remain stagnant, offering little scope for improving revenues and margins.

Petroleum Retailing Product or Service?

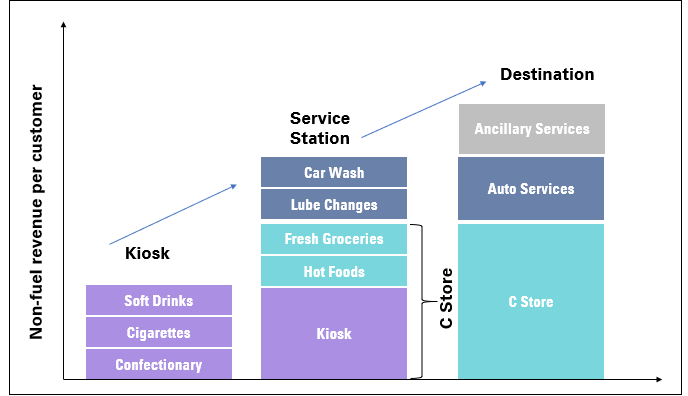

In growth markets, the major imperative should be to increase profitable revenues and market share growth. The petroleum retailers will need to develop differentiated value propositions, to improve revenues and their bottom lines; by adopting a customer focussed approach and build strong brand equity. To drive revenues and margins, the retailers will have to attract new customers or increase share of their existing customers' wallet. The latter can be achieved by offering non-fuel products and services. Non-fuel products, which offer higher margins compared to petroleum products, enable companies to sustain themselves, especially during times when oil prices are high. Though these products and services have been popular in the West, their importance is being recently felt in this region. Indian fuel retailers have started offering grocery, foods, laundry facilities, fresh foods, etc. at the convenience stores. UAE retailers are upgrading and adding similar facilities, to attract customers, and make them spend more time and money at their facilities. Petroleum retailing is a product and service, with differentiation possible in either or both areas.

Know your customer:

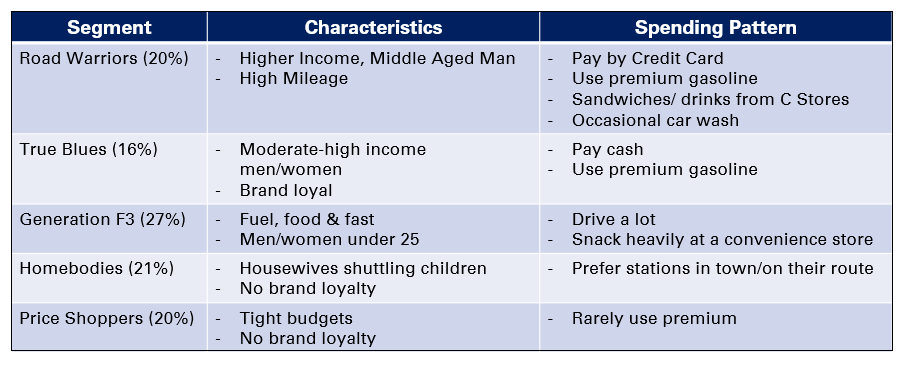

In developing products and services, the key is to understand your customer. Segmentation is a powerful tool to help marketers identify the requirements of the customers.

For eg. Mobil segmented the US petroleum consumers into 5 segments:

Mobil's customer segmentation in the US:

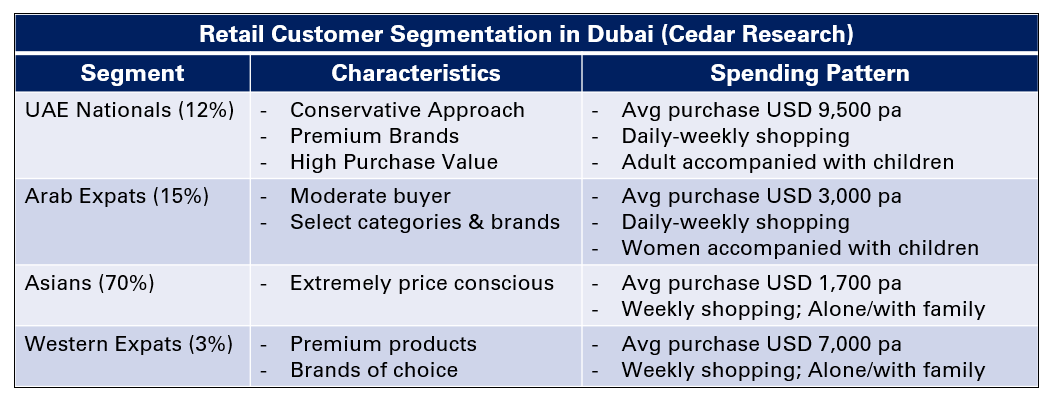

Mobil identified the top 3 segments as being the most profitable and developed its products and services to cater to the target customers' requirements. An exercise to understand the customer segments can go a long way for local petroleum retailers to identify the target segments and developing the appropriate strategy. Cedar has segmented the retail market in Dubai, as outlined below:

Product and Service Development:

Once the choice of target segment is identified, products and services need to be tailored to their requirements. The target customer should drive the value proposition, for both fuel and non-fuel products and services.

Fuel Based Proposition:

In the western markets, petroleum retailers sell multiple grade fuels based on the octane ratings, with different prices at different stations, where the customer can hunt for a bargain. In UAE, where unleaded fuel is the norm, 2 grades are available, Octane 95 and 98. However, the Octane 98 petrol accounts for less than 5% of the over 3.3 billion litres consumed. This could be attributed to the 25% premium over the Octane 95 product price, which is administered by the government. However, with the large high-end car population, an opportunity exists in the market to improve the perception of product superiority and improve the bottom line. In India too, with the introduction of stringent pollution norms, coupled with the growth in large cars, the superior product based opportunity is large. The first mover advantage needs to be captured and capitalised through a mix of customer education and marketing activities.

Site Security:

With expected new competition, site security is the key. In UAE and India, with the expansion of roads network, the existing players book the key sites, to beat future competition. However, development of the sites is undertaken once the road becomes operational. The challenge is to use a scientific site selection model, to ensure that the site is profitable once it is operational.

Site Rationalisation:

Even though site security is required, it is critical for managements to monitor performance of their existing and new stations. Loss making stations need to be identified, and corrective actions taken to make them profitable. If turnaround is not possible, it is best to close them and divert the resources for other sites or activities.

Site Upgradation:

The regional players have realised that having an attractive station, with friendly staff, and offering a range of non-fuel products and services, is the key to get customers to drive into their station. Depending on the site space availability, the various players in India and UAE have started renovating their existing sites, to offer an international look and feel. The challenge is to prioritise the sites that need to be upgraded first and which could start offering higher contribution due to the change.

Non-Fuel Based Proposition:

To get a larger share of the customers' wallet, non-fuel products and services are necessary. Non-fuel revenues contribute significantly for the petroleum retailers US(39%), France(25%), Europe (15%). In the UAE, it averages 12%- 15% for various players, and offers significant opportunity for development in the region, especially in India.

The non-fuel products and services can be broadly grouped into 3 categories:

- Convenience stores (C Stores)

- Auto Care Services

- Ancillary Services

Convenience Stores:

The concept of C stores though relatively new in India, has got established in the UAE for past 3-5 years. However the annual average revenue per sq ft in UAE is $325 compared to $550 in the US and $800 in UK. The average value per transaction in UAE is less than $3, compared to $6 in the UK.

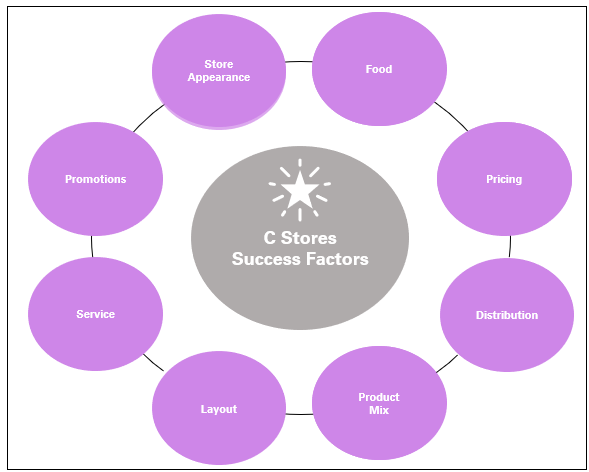

Factors contributing to the success of C stores proposition:

Product mix drives the C-stores shopping. In the UK, Tobacco (37%), confectionery & snacks (18%) and soft drinks (8%) are the leading categories. In the UAE, due to the wide availability of cigarettes in supermarkets, cigarette contribution is only 14%. It will be the same case in India, where there are cigarette kiosks at every nook and corner. The critical issue is to offer a product assortment that drives the target customer traffic. This could also be in terms of offering fresh groceries, fresh foods, coffee, hot snacks, etc. Also, special promotions in terms of discounts on high margin products can drive volumes (eg. Fountain soft drinks).

Store layout and appearance attract customers to spend more time in the store. This can be based on research to track the movement of customers, and hence the likelihood of them picking the product. Since operating C-stores require different set of capabilities in terms of supply chain management and sourcing, the C-stores operations could be outsourced. In UAE, all operators contract the fresh foods management to the food suppliers who replenish stocks on consumption and take back the unused stock based after expiry date. A reduced risk model is an alliance or complete outsourcing, especially in the branded hot foods category like pizzas, coffee, burgers, etc.

Auto Care Services:

Auto care services complement the fuel services. These include lube change, car wash, wheel & tyre services, car upholstery cleaning, minor repair services, etc. All of these contribute to the incremental share of the customers' wallet. The car wash and auto care average around 7% and 4% of the total revenues for fuel retailers in Japan and US. In the UAE it is between 1%-2%. Also, the lube to fuel volume ratio in UAE is 0.26%, compared to 1% internationally. However, in the UAE it is observed that where these services are available, their utilisation is high, therefore, they should be available at more number of locations. In India these services offered at the stations are at a nascent stage, due to the customers unwillingness to pay the price. Small garage operators tend to offer these services at a much lower price. The challenge is to understand the customers' willingness to pay, and design the service, coupled with right communication to promote them.

Ancillary Services:

ATMs, laundry facilities, Internet access, mosques (in the Middle East), etc. get the customer to drive into the station, and increase his spending. Emarat (Shamil) and Eppco (Tasjeel) in UAE also offer car testing, registration, and auto insurance facilities, which are certified by the authorities. This provides the customer a one-stop-shop for the car's annual check-up, and other formalities, with the luxury of an airconditioned facility, in less than 30 minutes compared to the half-day at government facilities. Door-to-door service is also offered, which requires even lesser time.

Other ancillary services could be potentially offered to include courier services, car rentals, etc, depending on the customers' requirements. The idea is to make the petrol station into a destination for the customer visit. Petroleum marketing has a strong non-fuel element, which can be leveraged for differentiation in a commodity market environment.

Customer Loyalty Programs:

We have been discussing the subject of acquiring/retaining customers and understanding their requirements. Customer loyalty programs enable organisations worldwide to achieve these goals. The loyalty program ensures that the customer limits the use of competitors' facilities, due to various incentives, which are offered to him. Secondly, it can capture the buying behaviour of the customer in terms of the types of products, purchase frequency, amount spent, locations used, etc. Companies can use this valuable data to differentiate and develop their product and service offerings, based on the customers' requirements, thereby improving revenues and profitability. Fuel Cards are being used in the UAE and recently in India, but primarily for fleet management. Investment in technology is required, to link all the forecourt and non-fuel facilities to a common data system. This investment can go a long way in understanding the customer.

Thus, a strategy based on building strong and differentiated value propositions is particularly relevant for petroleum retailers in this region, with an opportunity to build revenues and enhance profitability.

To read more such insights from our leaders, subscribe to Cedar FinTech Monthly View