The great Indian mall boom is here. Even Mumbai has found space for over 23 mega mall projects since 2003. From construction magnates, automobile manufacturers and even diversified conglomerates - wannabe retail players are lining up to get a piece of the mall pie. But there are warning signs that alls not well - mall rentals in Gurgaon plummeted by

20% within a month in the first quarter of 2005. A leading retailer recently vacated a prestigious mall in Mumbai even before the first year of tenancy was completed. The construction cost of a mall of global standards is in the range of Rs 1,500-2,000 per square foot. Thus mall investments are significant and require a break-even horizon of anywhere from 5 to 10 years. To sustain interest in a mall for that period of time requires serious thought and longterm planning. Some of the key long-term strategic imperatives of establishing a successful mall are:.

1. Get the Design and Aesthetics right

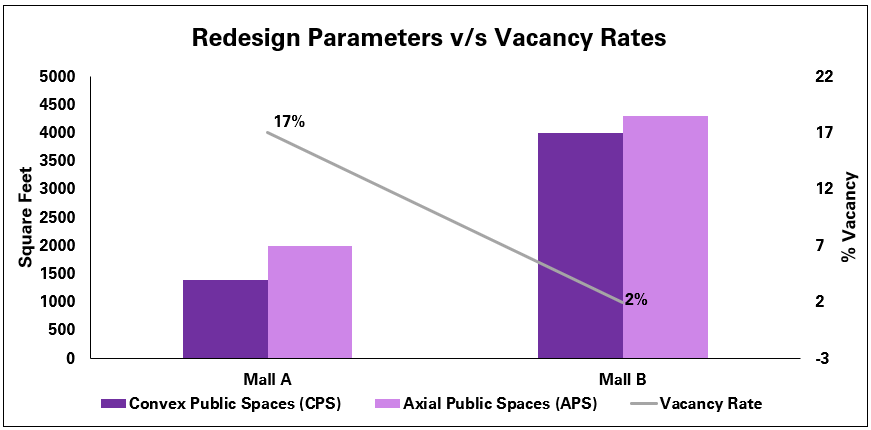

Mall design plays a key role in providing long-term value proposition to customers. Globally, the mall GLA (Gross Leasable Area) ratio varies between 50-60% to total floor area.However mall architects are pressurized to design high GLA (Gross lease-able area) to total floor area malls even as high as 80-90%. This might make sense in a spreadsheet, however compromises on mall design parameters like Axial Spaces Ratio and Convex Spaces Ratio. Convex spaces ratio (CPS) measures the degree of “openness” in a mall and Axial spaces ratio (APS) measures the level of fringing and accessibility of all mall areas. In addition, spatial design of mall core, fringe and anchor spaces is critical to ensuring mall footfalls are evenly distributed. Visual Discontinuity through inconsistent interior design can indirectly cause reduced span of mall visit. Lack of community areas can also restrict timespan of a mall visit restricting browsing capability of high value family shoppers. Research has shown a high correlation between faulty mall design and high vacancy rates. Mall visitors are less inclined to spend more time in, or develop sustained loyalty to a mall that does not give them the experience of an aesthetically superior public space.

2. Define a clear mall positioning statement:

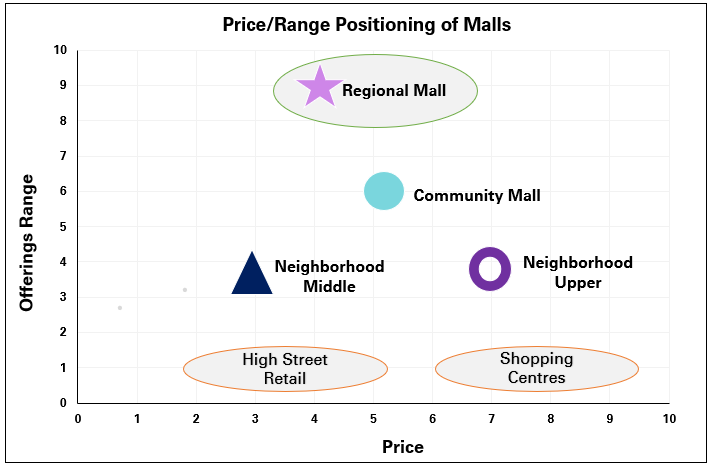

A mall that caters to high volume and low margin players would have different anchor and tenant strategies as compared to a mall catering to the youth. In the Indian context, apart from some prominent names, most malls are in the range of 50,000-100,000 sq ft of GLA which falls in the “Neighborhood mall” category. Only a few come even close to the half a million sq ft “Super-regional mall” sizes. However a lot of the new city malls do not have a clear positioning strategy and attempt multi-anchor strategies without having the GLA to support it.

Lack of clear positioning confuses both tenants and shoppers alike. Global Research into consumer shopping behaviour has shown that “browser” category shoppers tend to spend 15% more unplanned money, however are less likely to develop mall loyalty. So-called “destination” shoppers visit a mall for a particular good or service and get locked in for longer periods of time and frequencies. However destination shoppers leave home with a particular destination in mind- a children's play area, a community area, a furniture anchor, a book store, or even a cinema multiplex. In the Indian context there is lack of adequate understanding of regional consumer shopping behaviour such as North Indian target segment versus an Eastern or South Indian target segment and respective shopping or mall visit behaviour. A mall visit is about spending time rather than only money and positioning to your target segment allows you to create a destination through your tenants, public spaces and entertainment mix.

3. Build a sustainable Anchor strategy:

Anchors are the life-blood of a mall whereas the in-line stores are its muscle and bone. These are large format stores which pull in mall footfalls both from immediate as well as ex- catchments areas. Anchors can take upto 25% of the total mall GLA. Increasing beyond this can compromise having a robust tenant mix strategy which is being discussed later in this article. Choosing a flagship anchor is all about creating both merchandising variety and enduring categoric strength in the mall relevant to the primary target segment. In-line stores depend on the anchor for sustenance and cluster around it to get a piece of the footfalls. “Category Killer” anchors can decimate retail competition for that product for miles however require a ruthless blend of range, price and brand in a particular segment or product a rare and difficult expertise.

Well known category-killer anchors globally include IKEA for furniture, Toys 'R' Us for toys and Plug-ins for electronics. There are unfortunately few, if any Indian retailers which can come close to being labeled as a “category killers” both in terms of size and range. This leaves a large gap open for International retailers to occupy. Space availability at sustainable rentals is also an issue for Indian retailers with the capability to develop categoric strength. Malls should realize that Anchor strategies are never about rentals - anchors notoriously pay well below the market price for retail space and most often than not just about pay break even rents. However sustenance of in-line shops requires a robust anchor. To ensure that rents are attractive it is important that malls forms a “partnership” rather than a “rental” transaction with key tenants. Many of the new Indian suburban malls are loosing out on high quality Anchors and even key retailers on account of high rents which makes the outlet unprofitable. A last word- placement of a large anchor within a mall space is dependent on the anchor strategy, the spatial definition of mall core and siting of other in-line shops. More often, wrong anchor placement can result in fringing and inappropriate zoning thus causing in-line stores to loose footfalls and ultimately pull out from a mall.

4. Have a balanced tenant mix:

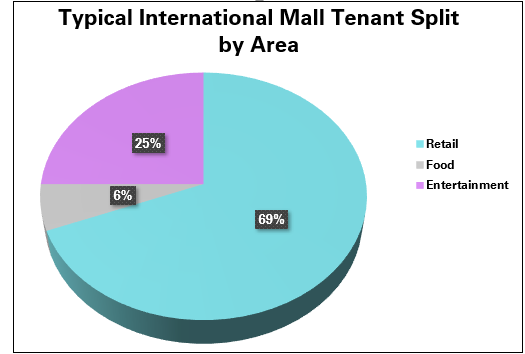

A well-planned and executed tenant mix can help a mall sustain its “destination” status even in the face of ferocious competition. The objective of a tenant mix strategy is to maintain the delicate balance between diversified product and service offering and revenue imperatives of the leasing business. Jewelry and food tenants typically pay the highest rentals while occupying the least rental area. Books, Music, Apparel and footwear pay the next highest rentals while anchors such as departmental stores pay 25- 30% of the per sq ft rentals of the in-line stores.

Maintaining a balance between entertainment, food and retail space is equally important to ensure that lack of sufficient options of any one of these does not become a differentiating factor in a mall- visit decision. International benchmark for entertainment space is at close to 25% of total GLA and for good reason. A mall visitor would find it excruciatingly painful to spend an entire half day in a mall only browsing shops. An entertainment break can increase the customary two to three hour mall visit to double the time. This can translate to one more visit to the food court or another look at the new jewelry shop. In the Indian context families are a large target segment and absence of an adequate children's play area or a senior citizens resting area can be decisive in a mall visit decision.

Malls also need to balance between the relatively modest price and high range option of the food court with specialized and maybe higher priced restaurants. Close to 40% of total GLA of a mall should be occupied by in-line shops with each category not occupying more than 5% of the total GLA. Globally apparel shops occupy the highest GLA after Anchors and Entertainment.

5. Parking:

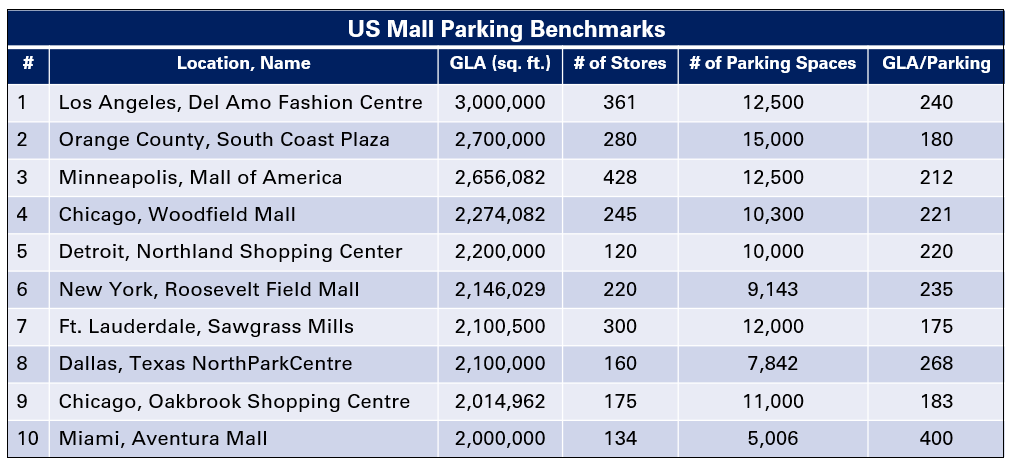

An often ignored part of long-term mall strategy is parking. Malls that target middle to upper middle class consumers have to provide adequate parking for visitors. Absence of adequate parking can cause visitors to be turned away frequently. This can reduce mall loyalty besides revenue loss. Global standard benchmark is one slot for every 200-250 sqft of GLA in a mall. Hence for a 50,000 sq ft neighborhood mall, at least 200 parking spaces need to be provided for. This is rarely the case especially in cities such as Mumbai and Delhi. A 200 capacity car park may need anywhere from 15,000

20,000 sq ft of space to be budgeted. In cities such as Mumbai, this can be a difficult proposition to meet and can even make projects financially unviable. However all mall strategies can be laid low if parking is inadequate and customer is turned away from the gate by the security guard.

Apart from these key issues, a mall strategy will also include zoning of tenants, mall maintenance strategy, competitive positioning, and a promotion and marketing strategy for the entire mall off and during festival seasons. Mall managements also need to manage mall-wide tenant behaviour. A leading mall in Mumbai has tenants opening and closing shop at varying times. To ensure mall visitors know where they stand in terms of mall timings, malls should have standard opening and closing times for all tenants- with entertainment and food zones being the exception only.

Although there are many malls that have mushroomed in the Indian context, the market is still ripe with opportunity. This is reflected in the famous quote of John Wooden “It is not so important who starts the game but who finishes it.”

To read more such insights from our leaders, subscribe to Cedar FinTech Monthly View