Hop onto this ship before it’s too late

The opportunity – Current state

I spent a considerable part of the last 6 months helping one of India’s largest (and oldest) apparel retailers in a specialized segment evaluate and re-vamp their e-commerce strategy. Consulting mandates of this nature typically involve an internal assessment of the current business and strategy, along-side and equally sizeable chunk of “external" research on the industry in the form of conversations with experts, interviews, and many forms of data-crunching. Both from a domestic as well as a global perspective.

My findings set the context and also describe the “current state" of this specialized segment in the online space. I summarize them with a few key takeaways.

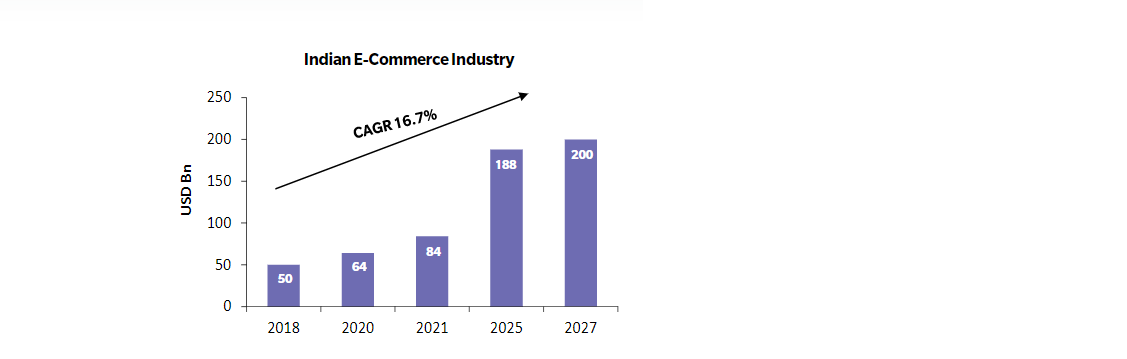

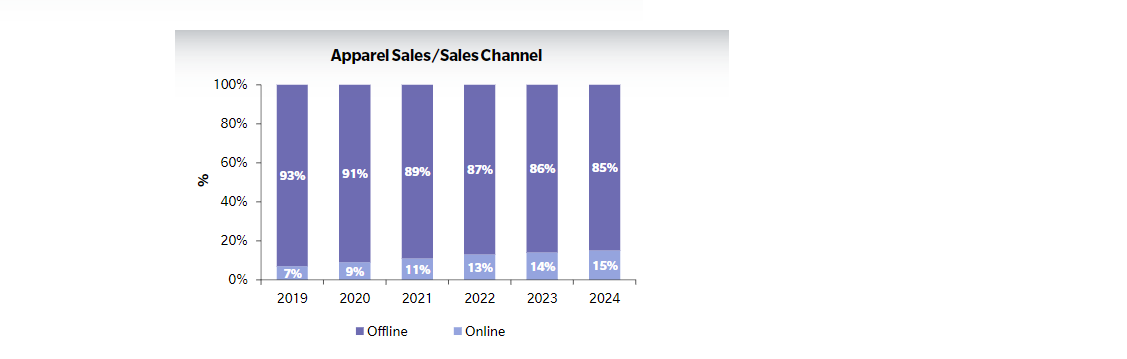

- Firstly, and clearly, the future growth trajectory definitely exists. A high estimated double-digit growth CAGR (~17%) for the online market, combined with an increasing contribution by online sales channels, makes the opportunity clear and exciting.

- Secondly, the key role that technology plays needs to be recognized and appreciated upfront. Businesses that embrace technology-first and mobile-first strategies with a strong user-experience focus, are thriving, while their competitors suffer or die.

- Third, kids and accessories can no longer be ignored as customer segments and need to be treated at par with menswear and womenswear categories. Fun fact: 10% of domestic and 20% of global e-commerce sales in the apparel industry is contributed by these categories. This will only grow.

Lastly, an important statistic to keep in mind is that of the 10% rule. Market leaders in this business currently generate 10% of their overall sales from online e-commerce channels. If you own a specialized-apparel business with an online strategy, getting as close to 10% as possible should be the goal for now.

Customer trends

If you truly believe that “Customer is King" then understanding customer trends for this market is important. There are two main ones.

- First, as I briefly mentioned above, a well-thought out Kids & Accessories online strategy is essential. Market leaders globally rely on these segments for ~20% of their total e-comm revenues, smart businesses create exclusive online ranges for these segments, and both the above categories are estimated to grow at a CAGR of ~25% in the coming years. It all makes sense.

- I introduce the second trend by opening with a baffling finding from my research. Which is that the most-engaging audience on e-commerce channels is not necessarily the audience that transacts the most. In fact, in most cases, it is not. Statistics from leading companies show that while 18-24 year-olds engage with e-commerce platforms 2-4x times the amount 24-35 year-olds do, ~65% of the transacting audience is still the 24-35 year-olds! While you could argue that part of the 18-24 age-bracket consists of people who do not have the financial independence to purchase, and therefore only browse, this data builds a compelling case. Companies need to ensure that they have a wholesome online strategy that pays special attention to converting the 18-24 year olds.

Third-party platform trends

Third-party platforms are “frenemies"to businesses that have an online strategy. While this is not only limited to the online apparel industry, I will stay focused on this one for our discussion. Sales and Marketing teams befriend these platforms and rely on them heavily for constant sales volumes and visibility amongst heaps of online visitors. On the other hand, for CEOs, CFOs, and other money-keepers, third-party platforms destroy profitability and margins due to deep-discounting (up to 50% for this category!) strategies that these platforms use. The right balance needs to be struck. No player in this segment in India or globally (in most cases) has ever built a significant online business relying solely on own-company websites and apps and ignoring third-party platforms. But players that relied solely on high-volume heavily-discounted third-party sales were not the answer to the problem either. They died after bleeding with margin compression and losses.

One popular hybrid solution is when brands launch exclusive product lines for third-party platforms. These products are manufactured, sourced, and priced with a top-down approach keeping the heavy third-party discounting in mind upfront. This often kills margin compression and profitability problems, and brands operate these online product ranges at different cost structures than those products in physical retail stores or own-company websites. Every company needs to find their own hybrid solution. Anybody who tells you that third-party-platforms are not important for almost any consumer category is probably lying to you or is not your friend.

Marketing trends

Think of the marketing as being the fuel that is needed to run the e-commerce engine of an apparel business. An absence of a brand and performance-marketing strategy will almost guarantee failure in trying to build an e-commerce business. In fact, somewhere below, I will go further to talk about the need for e-commerce-focused marketing too. Important marketing trends in the current landscape are summarized below:

- Marketing types: Brand-marketing is focused on marketing efforts to strengthen the brand name, image, values, and build visibility, whereas performance-marketing efforts are aimed at converting online traffic into customers and making actual money. A brand-marketing example is a short-video ad on YouTube. A performance-marketing example is a MPU banner with a click-to-buy option that follows you around on the internet. Both are crucial. Even the biggest and most successful brands in the world (E.g. Adidas) pay close attention to their brand-marketing efforts. Without a brand, there is no conversion, and therefore no performance.

- Omnichannel strategy: This one sounds basic but some of the world’s largest and most successful apparel companies are still figuring it out. The list of interaction channels between brands and audiences, online and offline, is longer than ever before, and calls for the serious need for there to be a seamless synchronization in content, communication, offers, and branding across all these channels, real-time. While some brands have aced their omnichannel strategies perfectly, a range of global and Indian brands are still figuring out how to leverage physical retail channels to drive customers online without cannibalizing physical-store sales, and communicate synchronized promotions and offers real-time across online and offline channels. Mastering this strategy is key.

- UI/UX as a marketing agenda: Companies have often made (and continue to make) the mistake of putting online user-interface and experience responsibilities in the basket of technology and design teams that sit outside the marketing function. Let us remember that conversion is core to any performance marketing strategy, and a high-quality user-experience is core to better conversion. It is all connected. It is therefore essential for Marketing teams to take complete ownership and responsibility on efforts related to user journeys and design. The best online apparel businesses recognize this more than ever today and invest significant amounts of time and money to internally or externally build world-class user experiences to drive performance. This is the responsibility of the Chief Marketing Officer.

Technology trends

The biggest technology trend in the e-commerce world today is focused around building strong e-commerce-focused technology capabilities that are separate and in addition to general company-wide technology requirements. Innovation in e-commerce technology tools is changing rapidly, and companies with significant online revenues are recognizing the need to invest in people, tools, and strategies that are dedicated to the role of technology in e-commerce. Market leaders who want to ride this trend are investing heavily in technology initiatives within their e-commerce business units, whereas players who are shy and hesitant to make a “double" investment in technology are relying on their company-wide CTOs to give e-commerce an extra bit of attention. The former model seems to be working better but at the end of the day it also comes down to how big the online aspirations are and how much one is willing to invest. Some other trends within technology are focused around:

- Artificial Intelligence:The trend: Smart AI-enabled website tools are being used to recommend products, adjust prices, and make offers to online visitors based on their browsing behaviour A use case: Nike acquired AI platform Celent in 2019 to use online customer insights to cross-sell products on the website and app

- Mobile Commerce:The trend: Mobile-commerce sales are expected to account for ~50% of overall online sales by 2021. Companies without mobile-first strategies are failing at the online game. A use case: Retailer Steve Madden launched their own mobile app in 2016. 75% of their total e-commerce sales are from mobile devices; accounting for ~USD 300mn. Read that again.

- Chatbots:The trend: Apparel retailers around the world are using bots and live chats to engage with customers on apps and websites 24/7. An interesting statistic: 83% of online audiences on e-commerce sites require assistance of some kind while trying to shop. A use case: H&M launched a chatbot service via Kik in 2016. The bot allows visitors to browse, compare, ask questions, and even transact by talking to the chatbot. H&M is also able to upsell and cross-sell effectively.

- Social Commerce:The trend: Social media users are growing every day and are estimated to grow to 3 billion by 2021. 71% of online brands (across industries) today are present on Instagram and Facebook and make use of check-out capabilities. In summary, the age of social media transacting is upon us and those who ignore it are losing out on significant online eyeballs. A use case: Adidas leverages an aggressive social commerce strategy globally. The adoption of Instagram’s check-out capabilities raised the brand’s online sales growth from 24% yoy to 40% yoy.

In concluding, let us not forget about the value of people and the key role they will need to play in implementing a winning e-commerce strategy. While some businesses successfully make do with internal expertise, most will need to look outside to bring in skilled and capable professionals who can use their e-commerce expertise with a dedicated focus. This gives birth to the need for there to be a “Head of E-commerce" in most such businesses in the short to medium term future. Somebody who thinks and operates differently from the experts running physical retail stores around the country. A completely different ball game.

To read more such insights from our leaders, subscribe to Cedar FinTech Monthly View