When banks tend to measure their “enterprise performance,” the discussion generally gets restricted to the financial performance - the asset book or the net profit, and in some cases, the branch network. While these do reflect growth, they are more of a lag-indicator of how the bank performed during the last reporting period, and do not reflect the sustainability of the performance on an on-going basis.

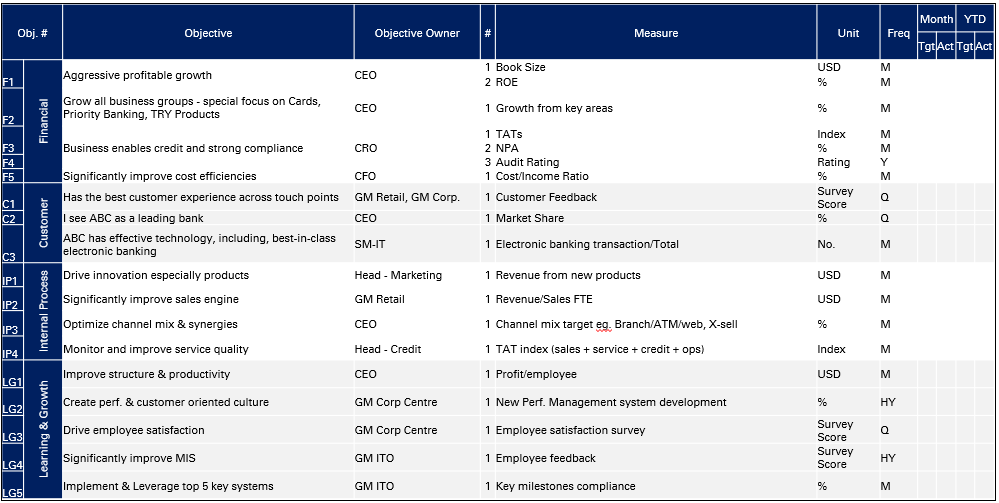

Considering that the ultimate purpose of the strategy is to drive enterprise performance, the balanced scorecard designed for a bank also needs to draw a balance between the financial and non-financial objectives across all four perspectives – financial, customer, process, and learning & growth.

The four key building blocks for an effective balanced scorecard in any industry would typically consist of developing the strategy map, defining the right measures, aligning key initiatives with the objectives, and assigning the right ownership. While the steps to build the scorecard are quite similar across industries, the challenges and nuances that are applicable to a bank can be quite different. More specifically, the key focus areas that need to be borne in mind while developing a balanced scorecard for a bank, through each of the four building blocks as defined above, could be quite different from other industries, and need to be approached appropriately. Let us explore these in greater depth.

Step 1: Building the strategy map for the bank

The strategy map, while establishing the top 20–25 objectives across the four perspectives, also has to drive the collective views of a bank – across multiple facets and business divisions. At the same time, the map needs to distinctly reflect the bank's priorities – both short-term and long-term. The biggest challenge is in building this balance.

While bank performances tend to get typically measured by the growth of asset book or net profit, a holistic assessment of the bank's performance needs to be based on measuring both financial and non-financial performance – which is the true essence of a balanced scorecard.while the steps to build a scorecard are similar across industries, the challenges that are applicable to a bank can be quite different.

Financial: Even while the bank tends to improve on its returns to shareholders, it is imperative to determine if the asset book

should grow faster than the margins, or vice versa. A good strategy map always helps define what would be the primary financial objective for the bank, also defined as “F1.” The financial objectives should well define the revenue drivers, cost strategy, asset book strategy, and risk management strategy.

Customer: With increased proliferation of differentiated segments, clarity on the segment needs and defining the proposition for the target segment is important in the strategy map. The value proposition essentially includes the product and service attributes, image of the bank, and relationship quality. It is critical to recognize the difference in approach for the corporate, commercial, business, and the retail banking segments, when one goes about defining the customer objectives.

Process: From the point of identifying the customers' needs to the point of having the needs fully satisfied, the process framework of the bank needs to excel in the areas of innovation, operational excellence, and delivery of service quality. Continuous improvement to internal processes serves as the backbone for delivering customer expectations. Not only should the process perspective focus on the products and services for the customer, but it should also set the right priorities for the channels – an area that is increasingly becoming important, especially when we live in an era of mobility and anywhere, anytime banking!

Learning & Growth: As the perspective that helps define the organization's objectives toward human competencies, technological infrastructure, and the climate for action, it pretty much serves as the foundation layer, and the organizational philosophy and its priorities. Being a customer service-driven culture could be quite a different ball game than being a process or performance-centric culture. It is not about what is right but about what is the higher priority for the bank at that point of time, and making that well defined.

Step 2: Defining the right measures

Measurement tends to be the key to the science of management. Having set the top 20–25 objectives that constitute the cockpit view across four perspectives, it becomes imperative to define the measures that best articulate the objectives. Unless the objectives can be measured, they cannot be managed. People respond to what is inspected, not what is expected, and therefore measures drive organizational behavior,

and help test the bank's progress in achieving the strategic objectives. So, what is different about the measures that need to be defined for a bank? It is all about selecting the right measures that help calibrate between lead and lag factors, and a mix of ratios, monetary values, and survey results. Typical examples of measures applicable in the banking context include the following:

Financial perspective: Typical financial measures include ROE, ROA, asset book (corporate, commercial, business banking, retail), fee income, cost of funds, cost efficiency, asset utilization, and NPL%.

Customer perspective: The customer related measures generally include customer acquisition, channel transaction mix, cross-sell percentage, products/customer, customer satisfaction index, and customer attrition. Product features, image, and relationship strength are key measures for a successful customer and product strategy.

Process perspective: Since this is reflective of the efficiency and productivity, the typical measures include operating cost, process SLA, branch transaction cost, and alternative channel penetration. Compliance is also measured by audit ratings.

Learning & growth perspective: Measurement of training days/ employee, percentage of variable compensation, and employee satisfaction drive organizational measures. Technology related measures include key milestones of technological initiatives and quality of MIS.

Tightly linked with the choice of measures is the process of defining the targets. Targets need to be defined as a mix of easy, realistic, and stretch targets. A select set of measures may be defined to be “break-through” targets, which help in aspirational growth or quality. I know a CEO of a large retail bank, who is famously quoted by his team for walking into the planning session, writing a number on the whiteboard that is way beyond what has been planned by the team, and walking out without uttering a word, but with an aspirational message well delivered. Well, that is a breakthrough target that his team is expected to deliver, no questions asked!

Step 3: Aligning key initiatives

While objectives help articulate the destination, the approach to reach them still depends on successfully delivering the right set of initiatives. Unless the right initiatives are defined and prioritized appropriately, it is quite hard to achieve the measures set for each objective, however straightforward they may be. Initiatives are means to deliver the end, which are the objectives. It is not uncommon to see banks mixing up initiatives with objectives. For instance, a Lean-Six Sigma business process reengineering exercise is not an objective but an initiative that will help address a financial or process objective, just as a core banking platform transformation will help with a learning & growth objective, or a rebranding initiative will help address a customer objective. Interestingly, the process of identifying the initiative and mapping it to the objective has a consistent pattern that we have observed across multiple banks where Cedar has helped in developing the scorecard. Some of the most common initiatives that are important for delivering the strategic objectives are as follows:

1. Financial and cost efficiency: Typical initiatives include new market and branch expansion, fee income improvement, asset mix realignment, risk management, and cost reduction exercises.

2. Products and channels: Market research & assessment, new product development, alternative channel design and migration, building loyalty program, realigning branch locations, fees and charges realignment.

3. Process enhancement: Activity based costing, Lean Six Sigma process enhancement, process centralization, process and technology outsourcing.

4. Organization and human capital: Organizational structure design, compensation benchmarking & realignment, ESOP program design and rollout, training and development, employee engagement, performance management system design.

5. Technology: Core banking transformation, key application rollout – CRM, loan origination, treasury, ALM & risk, transaction banking system, data warehousing, business intelligence, HRMS, and enterprise GL.

It is all about selecting the right measures That Help calibrate between lead & lag Factors, and a mix Of ratios, monetary values, and survey results.

Step 4: Assigning the right ownership while this is generally quite a illustrative bank balanced scorecard

straightforward activity, there is a science behind assignment of the right ownership to every objective. No matter how tall the objective is and how effective the measure is, an objective that is not owned will ultimately be an orphaned objective. Even while there are differences about the owner for the objective, it is important to recognize that the custodian of the “data” that provides the status of the measure need not be the owner of the objective.

This is a subtle but important fact to be kept in mind. There are four simple rules to be borne in mind when objectives are assigned to owners while designing and implementing a scorecard:

1. Define primary ownership: The F1 or the primary financial objective should be the responsibility directly owned by the CEO. If it were a cascaded scorecard of a business unit such as corporate or retail, the unit head would be the owner for the primary financial objective.

2. Ensure singularity of ownership: It is a preferred practice to have ownership of an objective assigned to one owner. Joint ownership with more than one owner should ideally be an exception than being the rule.

3. Align objective-initiative ownership: Where the initiative is directly linked to an objective one-to-one, the ownership of both initiative and objective is best assigned to the same individual.

4. Align enterprise-individual performance measurement: Lastly, the objectives that have the direct ownership from an individual are best linked to the individual performance measure (IPM) as well. This also helps to build the linkage between the enterprise and individual performance measurement.

The value of any measurement tool is as good as its usage. The key to successful leverage of a balanced scorecard lies in making it an integral part of the day-to-day business-as-usual. When the monthly meeting of the CEO is based on the performance as indicated by the measures of the 20–25 strategic objectives, not only does it bring in the effectiveness of focus to the conversation, but it also enables a deeper dive into the nature of the underlying issue that had potentially resulted in the performance or the lack of it. Aligning initiatives with the objectives and building the ownership therefore becomes imperative. After all, what cannot be measured cannot be managed too!

To read more such insights from our leaders, subscribe to Cedar FinTech Monthly View