Measuring is a science,

selecting measures is an art.

The balanced scorecard, a leading global enterprise performance management tool, brings together a company's objectives and related measures across finance, customers/ stakeholder management, processes, and organization and technology domains.

A well-defined roadmap is critical for an organization's success in today's dynamic environment. The elements of this road map, including a company's overall objectives/goals, should be based on external market conditions and internal capabilities and or past performance. Too many objectives confuse and serve as an impediment to success. So, as a thumb rule, a company should have 20-25 well-defined and clear strategic objectives. More importantly, these objectives should cover the entire spectrum of a firm's operations across financial performance, customer/products, key internal processes, human capital, and technology. It is also critical to ensure that these objectives are SMART-strategic, measurable, achievable (or else they can demotivate), realistic, and time-bound.

While such objectives are important, they -by themselves are insufficient. It is necessary to measure and track progress (good or bad) toward achieving these objectives. To do so, for each objective, specific and relevant measures need to be put in place. These measures will help focus management and employee attention on essential factors for success. Similarly, simply laying out a long list of measures without associating them with objectives will not provide a holistic view of its strategic goals and plans to achieve them. Periodic reporting of these measures will enable an organization to review its performance, reflect on what went right and what went wrong, and outline a clear action plan for the next performance period/cycle.

The Balanced Scorecard-a is a leading global enterprise performance management tool-brings together a company's objectives and related measures across finance, customers/stakeholder management, processes, and organization and technology domains. It also facilitates periodical reporting for timely review, corrective actions, and most importantly, strategic decision making, thereby serving as a strategy deployment tool and not just a simple management information system or a plain vanilla dashboard.

Now, as we all know, a company's performance is ultimately driven by its employees. Therefore, measuring a company's performance is only possible if the performance of its key employees is also measured. Individual performance measures are relevant measures defined for each position. As is often seen, being measured serves as a motivating factor. Am I being measured? Is my progress being tracked? Will my achievements be rewarded? Aren't these first few things that cross our minds when asked to execute a task at work? Yes, they are. Assessment of our performance or measuring our performance drives us to do our best. Therefore, it is often said that "what gets measured gets done."

Having established the importance of measures and measurement, there are certain key attributes that must be remembered while defining and selecting these, both at the company and employee levels. The trick is not in identifying a long list but in identifying and selecting a handful, carefully aligned to, and having a direct impact on the objectives (no more than 2-3 per objective). The more, the merrier rule does not apply here.

Often only financial objectives dominate a company's decision making. The drawback to this is that financial measures typically only reflect past performance.

These are frequently good lag indicators of performance. To drive future performance, preemptive indicators need to be considered. For example, the number of sale in a situvation where a firm's goal is to grow sales, these lead indicators are more useful than only measuring total sales. For overall improved performance, a combination of lead and lag measures are essential. Typically, approximately 40% of the measures should be lead indicators and balance lag indicators. This obviously could change depending on the growth stage of the company. In a high growth stage, a company should ideally have more lead than lag indicators.

In addition, measurement of performance in only the financial domain does not give a complete view of a firm's progress in achieving its objectives. Non- financial aspects drive the firm's financial performance, and therefore it is important to add these. In my experience of approximately 100 scorecards, financial measures typically account for only approximately 40%, and non-financial measures account for the balance.

While quantitative measures form the backbone of all measures, certain qualitative measures should be considered. Many firms often use indicators, such as a customer satisfaction score, to refine their products/offerings and improve overall customer service processes. Another example is employee satisfaction, a good lead indicator for customer satisfaction. "The more motivated and satisfied employees, the more likely they are to serve customers well."

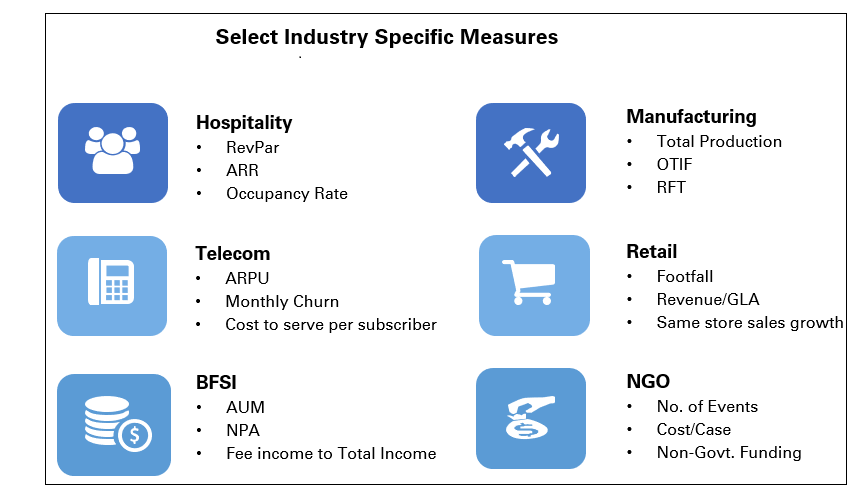

While some measures may apply to all Industries, each industry has a specific set of unique measures. For example, revenue p&r arrival is a critical measure for hotels; average revenue per user is unique to the telecom industry, footfalls for retail, Right first time(RFT) for manufacturing companies and non-performing assets for financial services.

As an example, let me describe an instance where the art of selecting the right measures was imperative to help a client improve its performance. Our client, a leading home textile manufacturer with approximately $1 Billion in revenue and 12,000 employees, had recently expanded its towel production capacity by 100% and also added a new sheeting plant. It had also recently been reorganized to a functional organizational structure, creating teamwork challenges. Amidst this reorganization and drastic expansion, management seemed to have lost focus on the overall objectives. The company's performance was off on multiple critical parameters, including financial parameters, order book product quality, and productivity, creating significant enterprise risk. Cedar addressed these challenges by developing a corporate strategy map and scorecard to help focus the leadership team on the key challenges. Approximately 60 cascaded scorecards were also developed to drive performance at the departmental level.

The selection of measures is a double-edged sword, and if done incorrectly, it can create havoc and demoralize employees. There is also no one correct way to choose measures, and it is situation and company-specific.

For each of these scorecards, while the objectives were collectively decided, given the market environment and company competencies, the choice of measures was what made the difference. Measures for each objective were carefully selected to balance lead and lag. For example, for the objective of improving cash flow, a measure of free cash flow was introduced; for the objective of profitably growing revenues, a lead indicator for sales and marketing innovations was added. Any cost-effective innovation in the way products could be sold would ultimately contribute to overall profitable revenue growth. Similarly, an effort was made to include both qualitative and quantitative measures. To increase the average ticket size per customer, it was vital to ensure and measure customer satisfaction and overall equipment efficiency. RFT, on-time in-full, and conversion cost were introduced from a manufacturing standpoint. These measures enabled the leadership to focus its attention on the key challenges and collectively deliberate solutions. The selection of measures is a double-edged sword; if done incorrectly, it can create havoc and demoralize employees. There is also no one correct way to choose measures; it is situation and company-specific. While measuring itself may be a science (it is usually based on formulas and data), the process of carefully identifying, deliberating, and selecting measures is an art. It is an art because it has good judgment, business experience and technical knowledge coupled with the right balance among lead, lag, non-financial and financial, and qualitative and quantitative while aligning to overall organizational strategic goals.

To read more such insights from our leaders, subscribe to Cedar FinTech Monthly View