Increasing popularity of Employee Stock Options

Organizations, especially in the services industry, are increasingly getting to realize the value of retaining their biggest resource: people. While HR managers around the globe are determining innovative retention programs, Employee Stock Option Plan (ESOP) has emerged one of the most popular retention and employee motivation programs in the last few years. In a recent poll conducted by Business world in India, 63% of employers have confirmed having an ESOP program or planning to have one in next 12 months. ESOP is also gaining immense popularity in the UAE and other GCC countries, where the markets have seen a significant growth in the recent years, and employers see the need for aligning with international best practices to keep their employees motivated. The popularity of the program is not only in the beauty of sharing the organizational profitability with its key employees, but also in in driving it towards employee loyalty and motivation to perform without immediate cash outflows.

However, there are obvious strategic and regulatory considerations that one needs to look at before offering such a program. A successful ESOP program would not only need to address the regulatory requirements, but should also lead to meeting the strategic objectives set when it is designed. This note looks at some of the essentials in designing a successful ESOP program, and ensuring maximum benefits through the scheme

ESOP: Defining the need:

An ESOP program is essentially an option provided to employees of an organization to buy an allotted share of the equity at a future date, at a price determined at the time of grant. The employee benefits if the stock price moves up, and the difference between the grant price and the market price at the time of vesting is the benefit. It is still a right, but not an obligation for the employee to buy the shares. While the concept was developed way back in the 1950s and is commonly used in developed countries, the program has picked up steam in the region over the last decade.

The first step to building a successful ESOP is in defining its objective well. Building the properties of the program is a function of what it is ultimately expected to achieve. Based on our experience, organizations tend to look at a combination of the following as the intended objective of an ESOP program, which also have a bearing on each other:

- Enhance Retention: perceived value of future benefits retards attrition rates.

- Reward Performance: linking ESOP value to performance is a motivating factor.

- Attract talent: ESOP becomes a close substitute for financial benefits.

- Reward Loyalty: value of the grant being directly proportional to years served.

Clearly, the design of the program in terms of who is to be given, how much, when to grant and vest are all a function of what the intended objective is. The primary objective in most programs still remains employee retention and enhancing performance

Building the mechanics of an ESOP Model:

Clearly, the design of the program in terms of who is to be given, how much, when to grant and vest are all a function of what the intended objective is. The primary objective in most programs still remains employee retention and enhancing performance

Defining the right mechanics for your organization's ESOP program, aligned with the strategic objectives as set above, is the most critical step of a program. While there are a plethora of options available to designing the program, choosing the right combination of program elements, and structuring it to address the fundamental needs of the organization is a delicate art. Some of the key elements to look at in an ESOP will be as follows:

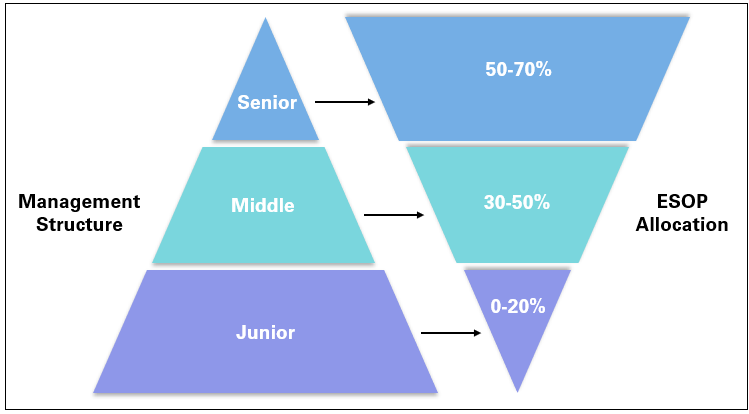

Whom to give?

This essentially becomes a challenge as the organization grows. While the distribution kitty is finite and limited, the value shared with the employee also needs to be substantial enough to motivate. That automatically implies that the firm needs to choose whom to give, and this is normally limited to senior and middle management layers. Generally, the distribution of ESOP resembles the “inverted pyramid” senior management would need to be allotted a higher share.

In our experience, determining who should be the recipient of ESOP is clearly a derivative of the criticality of the role that an employee plays, and the rating on his/her performance. This is even more important when it comes to distribution for senior management of an organization. Qualitative assessment of the role and criticality of an individual should supplement his or her quantified performance measures, and ensuring objectivity of the process is quintessential.

When to give?

A typical ESOP program runs for 5-7 years, during which the vesting of the shares is typically scheduled. It is not uncommon to see companies run annual ESOP programs, which therefore would run in parallel with programs of previous years.

The critical issue to be looked at here is, what is the vesting distribution planned, and how does it balance the interests of the employee vs. that of the employer. For example, if 90% of the shares are to vest after 5 years, it seldom serves as a retention tool. On the contrary, upfront loading will lead to a situation situation of “immediate cash-out”, compromising the basic objective of enhancing loyalty. Striking the right balance is the key to success.

How much to give?

Is clearly a function of what value is acceptable to address the fundamental objective, and when does it go beyond the circuit breaker. For example, unless the benefits of ESOP are at a certain multiple, say 5 times of the current earnings of the employee, it would not serve the purpose of retention and motivation. However, there are obvious limits on how much of overall equity can be diluted and shared with employees.

Although regulations in every country vary, the broad thumb-rule is to have up to 10% of the total equity allocated for ESOP, depending on the industry. Only a fraction of that, however, gets granted every year. And point to note here is not all the granted options are vested, and hence remain in the ESOP pool for reallocation thereafter.

Discount to share price: how much is enough?

Normally the grant price of a stock option would be the average of the previous week's last trading price. Unlisted companies undertake a valuation exercise to determine the share value. It is not uncommon for companies to provide a discount to the share price, and account for it in the P&L. However, the discounts need to be reasonable, and managing employee expectations is critical here. If it was to hit the P&L anyway, one could have instead just provided a bigger bonus than go through the entire rigmarole of an ESOP!

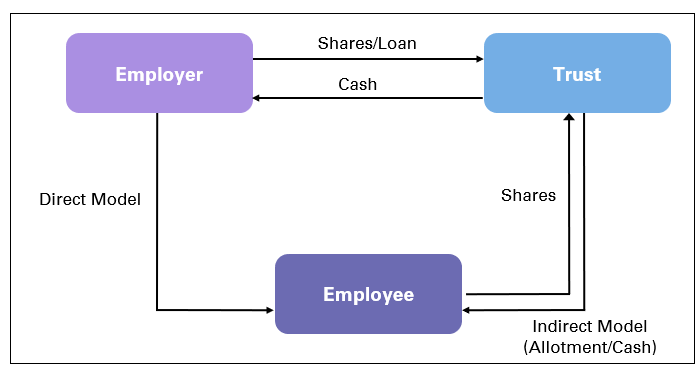

ESOP administration: direct vs. indirect approach

While the transaction between the employer and employee can be direct and straightforward, organizations especially those unlisted, also adopt a “trust” model, wherein the trust maintains, manages and transacts with the employees. This is quite common where the employee does not undertake any direct cash transaction initialy rather takes a notional loan; the difference in price between initial grant and market price at time of execution helps ‘settle’ the loss and transfer the profit.

Sustaining the benefits:

Success of any program needs to be measured by the quantitative benefits it brings in. 71% of companies surveyed by ESOP Association in the US have reported to have improved their employee productivity levels. Periodic measurement of the actual performance vs. the expected improvements in retention, productivity and talent attraction is important to help revise and refine the program structures appropriately. Organizations launch ESOP programs, on a periodic basis to build sustained interest across the enterprise, and make it participative for the “new qualifiers”.

The other important factor is the communication strategy which is critical to an ESOP's success. Employees need to know the plan is available and understand why the company is offering this wealthcreating benefit. Potential and current customers should also be aware of an ESOP's existence, because customers often value the idea of doing business with an employee-owned company. Leading organizations, constantly reminds its employees about the company's ESOP through employee orientation, regular training, and day-to- day endorsement.

Employers also link the vesting rights to sustained performance of the employee but this may also turn out to be a “double whammy ” the option was allotted in the first place based on performance, and building another layer of constraints around vesting may lead to a “sour grape syndrome”. However, motivation to perform does get enhanced when there is enough awareness within the organization of future ESOP programs, and the qualifying factors that may lead to being benefited

What to watch out for:

Although ESOP is a proven instrument to motivate and retain employees, it also comes with its pitfalls. Some of these are inevitable, but being forewarned is to be forearmed. Listed below are some of the classical challenges which an ESOP program can bring about:

1. Carrying the dud: When performance and criticality do not overweigh loyalty factor in the allocation model, organizations may end up rewarding poor performers with stock options. Since the programs are intended to encourage retention, one may end up with 'seat- warmers' becoming even more loyal, waiting to vest before they move on!

2. Drain to bottom-line: As discussed earlier in this paper, ESOP programs may sometimes prove costly, unless the pricing is calibrated right. Too much of a discount to the fair value would not only affect the bottom-line, but may also lead to encashment and exit. Again, where it involves senior management and board compensation, corporate governance principles should prevail over greed especially where regulations do not restrict value or quantum of grant.

ESOPs: Soon to become a 'hygiene' factor

With the increasing demand for retaining the right talent, ESOPs have already become a common practice is many organizations, and more particularly so in the “knowledge industry”. Organizations have also become more aware than ever before, of the need to create and communicate a performance driven culture within the organization. It is but natural that ESOPs are here to stay, and become a standard part of a typical compensation structure.

Building an effective ESOP program may therefore not just have a bearing on the immediate benefits to the employees, but are most likely to influence the culture within the organization, and potentially define the performance-reward mechanism with greater clarity. Balancing the enterprise performance with that of the individual's has always been a matter of significance for managements and HR functions, and ESOP has already become a powerful tool to demonstrate the linkage. Hence, an ESOP program is not just another one-off employee motivation program, but a very well-defined instrument that helps aligning business strategy with HR and people management initiatives. Getting it right, therefore, just became even more important!

Author | V. Ramkumar

For a further conversation on this subject of Cedar View or how we may be able to help please email V. Ramkumar, Senior Partner, Cedar at V.Ramkumar@cedar-consulting.com