There has been an increasing trend amongst banks to embrace digitization. And the reasons are multi-fold – to improve banking efficiency, attract and retain new customers, improve analytics, launch innovative services and enhance product customization.

A greater proportion of this transformation is more evident in smaller banks than in the traditional big banks. Perhaps this is because of the difference in definition of digitization: while the bigger banks think of it as use of technology to process and automate banking transactions, the smaller and nimble financial institutions in contrast think of it as “leveraging technology to increase market share and improve customer acquisition and retention rates.”

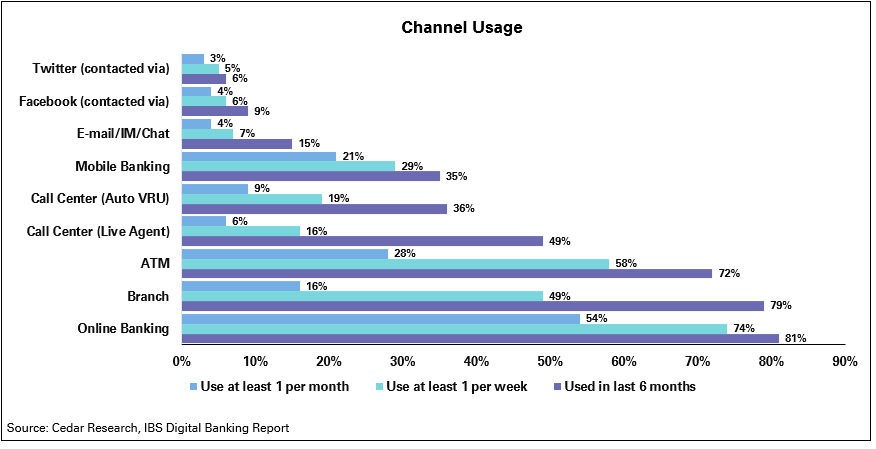

Several traditional services are being transitioned to a digital format and each service is being adopted by customers at a different rate. Some services have caught on faster, while others are lagging in their acceptance. Organizations that are at the forefront of the digital transformation understand that it is not a fad, but a necessity in order to maintain competitiveness, improve customer experience, and evolve as more integrated and streamlined organizations.

The uptake in investments in digital banking, be it for the big and old, or the small and new banks, are largely driven by the increasing usage of mobile and online banking and the advancement in analytics technology.

BUILDING BLOCKS OF DIGITAL BANKING

First, digital banking starts with the thought or philosophy that banks will provide the customer with services or product of their liking through channel of their choice. This means customer data is cleansed and stored in a secured way that can be accessed internally or externally through various form factors. Effectively this means banks as a part of digital strategy are completely IP driven and connected to the external world in a secured way to prevent fraud and cyberattacks.

Second, the digital bank creates outreach. It does not necessarily expect customers to change behavior and adapt, rather, banks change their processes to adapt to customer behavior. In other words, customers can interact and transact with the bank not just via contact centers, but via social networking, messengers, emails, cards or any future electronic channel.

Third, it is not just interacting but storing, analysing the information, and providing the services as required. Using predictive and cognitive analytics offers relevance by better understanding customer behavior. For example, if a customer asks about a loan product through a contact center and logs on the bank’s web site to check interest rates the next day, should he happen to visit the nearest branch, the personal banker should lead the discussion towards a card loan and have a specialist on call if required.

THE DIGITAL BANK DOES NOT

REPLACE THE HUMAN ELEMENT,

BUT AUGMENTS THE EXPERIENCE

BY PROVIDING A NON-INTRUSIVE

“ALWAYS ON” CONCEPT.

As depicted in the illustrative, it is not an adjunct or addition but is core to a bank’s philosophy. There are many other factors that create a digital bank, but this last piece is probably the most important: that of the culture. It is the bank’s leadership that creates a digital culture.

WHAT IS DIGITAL BANKING

The definition of digital banking often eludes many of those both inside and outside of the banking industry. Some see it simply as mobile or online banking, some see it as automation of processes and others perceive it as electronic fulfilment of services.

In a strictly technological sense, digital banking has existed since the 1950s, when the first mainframe computers were used to process banking transactions. However, the meaning of digital’ in today’s context has become far more broad and nuanced. This is driven by a number of new technological and consumer trends that have combined to create a unique set of circumstances rapidly reshaping the banking world including: mobility, automation, connectivity, big data, cloud computing, and artificial intelligence.

The Financial Brand defines Digital Banking as:

- Delivering a customized, but consistent brand experience to customers across all channels and points of interaction.

- Underpinned by analytics and automation.

- Requiring a change in the operating model, - products / services, organization, culture, and skills and IT.

- Delivering demonstrable and sustainable economic value.

In other words, digital banking is about making traditional banking processes seamless and smooth using technology, delivering a consistent brand message to customers across all channels, and automating services as much as possible.

DIGITAL BANKING AND CHANGING BANKING MODEL

Conventionally the bank branch was the center of the banking experience. All interactions with customers originated with the branch experience. The customer definition was confined to the branch’s footprint. The digital channel was only a layer on top of the branch system.

However, with the advent of technology, traditional banking operations and processes globally are in a state of flux, as banking customers become more techsavvy and embrace digital devices and technologies for financial transactions.

With this evolving landscape, the definition of a customer itself has changed. In a conventional banking model, anyone who holds an account with you is defined as your customer; however, in the digital context if we redefine the customer as anyone who comes to your website to “shop,” or who uses your ATM, or cashes a check at your bank, etc... a customer is no longer confined to that footprint.

DIGITAL BANK – KEY DRIVERS

Ubiquitous roll out of telecom network, cheaper handset cost, advanced decision making techniques and favorable regulatory environment opening access to data are driving the digital banking. The key drivers can be listed as below

Changing consumer habits: Mobile and online shopping have become much more popular in recent years. In 2012 online retail spending was about $231 billion in the United States and it jumped up to $262 billion in 2013. In 2014 it went up again to $291 billion, and it is anticipated to continue to rise for 2015-2017, primarily driven by consumer adopting of Online and Mobile banking channels.

Adaptation of channel preferences: : In 2013, usage of mobile banking jumped 40% with 95 million adults in the United States utilizing it, and the adoption rate is expected to rise every year until at least 2018 based on a recent study. The rapid rise in the popularity of mobile banking is attributable to the increase in the adoption of tablets and smartphones globally. In 2013, there were 74,000 new users of mobile banking added daily in the United States. As shown in chart below ,the number of global mobile banking users is growing by ~ 22% and is also expected to increase to 1.9 billion by 2019, while there were already 700 million mobile banking users globally in 2014.

The adoption of mobile banking is not restricted only to the western world, but also far beyond in developing countries like China and India, with mobile transactions accounting for approximately 60% of all banking transactions in China, and approximately 50% in India. Online banking usage is the second key indicator of the global digital banking market. General global internet usage has increased tremendously with the majority of usage in Asia. In 2015, there were over 3.2 billion internet globally. China has approximately 19.2% of the total global internet population, followed by India (17.5%) and the U.S. (4.45%). As of January 2014, about half of those under the age of 40 in Asia preferred online or mobile banking, and trends shown in chart below; depicts that Asian customers are becoming more comfortable with digital banking.

Enhancement in connectivity: The speed of connectivity between consumers and the bank’s services is one of the biggest reasons for adoption. Connectivity mainly refers to two parts- How banks can use social networks in order to build more brand loyalty and secondly how modern communication protocols that are used to increase the speed and efficiency of transactions. With proliferation of both social networking and communication links and protocols becoming cheaper and faster, it has a direct positive impact on digitization of banks.

Availability of data set and enhancement in decision techniques: Big Data decision analytics is the process of using big data to make more efficient and accurate customer purchase predictions, or decisions regarding customer risk. Using up-to-date data sets from an evolving ecosystem, as well as transactional history of the customer; banks are now able to sort through the deluge of data that they have in order to create smaller and smaller customer segments with personalized product and service offerings.

EMERGING TRENDS AND OPPORTUNITIES

The opportunities can be classified as revenue levers and cost levers that are impacted due to digital banking. While there are opportunities, there are challenges and it is important to understand the challenges to draw strategies to overcome the same.

1. Revenue Levers of Digital Banking

Revenue levers are associated with developing customized product offering, managing higher cross sell, increasing customer lifetime value.

Capturing and Servicing new customer segment: The customer segments can be broadly classified as digitally challenged, digitally adaptable and digitally native (generation Y). Digitally challengedThey are aged 50 and above and show little interest in utilizing technology for investing and managing finances. They possess an estimated $ 1 million plus in investable assets in North America. Digitally adaptable or Digitally Middle - This demographic exists between the digitally affluent and generation Y. These middle class and established consumers have small, but significant sums in investable assets, and are evenly split between those engaged with digital banking and those not, however this segment is relatively more adaptable to technology. Digital Native or Generation Y -This consumer group is composed of young professionals and students aged 18 to 32. They live digitally-focused lives, and form the base of digital banking’s future. Roughly 30% of this group attempted to open an online account over a 12-month period. Gen Y is projected to represent 40% of all financial transactions in the next few years. Capturing and keeping generation Y requires much more effort and resources. Digital banking represents the opportunity of targeting and servicing the burgeoning population of digital middle and generation Y.

Better customer insights: The ability to gain a better understanding of customers to drive strategy has always been of interest to financial marketers.

DIGITAL BANKING PROVIDES

BIG DATA TECHNIQUES

THAT OPENS A NUMBER OF

AVENUES AND TOOLS THAT

BANKS CAN USE TO GAIN

BETTER INSIGHTS ON THEIR

CONSUMERS AND PROSPECTS.

Better customer life time value and customer retention:One of the most important and most complex things to do is identify which customers are going to spend the most money over the longest period of time and what products suits their needs the most. This is the kind of insight that lets companies optimize their marketing efforts to target the most valuable customer segments. The 360-degree view that digital banking offers is extremely useful in drawing this particular insight. Research indicates that banks that use Big Data analytics techniques on customer data have a 4% lead in market share over banks that do not, and those that use analytics to understand customer attrition have a 12% lead in market share over banks that do not.

USING PATTERN ANALYSIS

OR MARKET BASKET

ANALYSIS, SOPHISTICATED

ALGORITHMS ARE APPLIED

TO PREDICT A CUSTOMER’S

NEXT BEST OFFER, AT THE

RIGHT TIME; THROUGH THE

RIGHT CHANNEL.

Relationship based pricing and credit scoring:A good understanding of customer value can help banks offer relationship pricing on products like loans and deposits. Most banks face an issue of data being scattered across business units. While it may be hard for banks to centralize data on customers to get an accurate idea of risk, there are alternative digital tools out there which may provide a solution to deal with this problem.

Upsell and Cross sell / Next best offer:Next best action analysis refers to the use of predictive analytics to identify the products or services customers are most likely to be interested in for their next purchase. This helps in increasing customer satisfaction, maximizing profits and reducing risk.

2. Cost Levers

Cost can be classified as operating cost and capital cost. Operations cost is further segregated in two parts, cost of running processing operations and cost incurred due to utilization of recourses by customer. Impact of digital banking on cost reduction is as follows:

Reduce distribution costs through improving the channel mix:Distribution costs are typically inflated by ineffective channels. Channel mix improvement, enhanced by IT, and preferences of its audience eliminates waste. Optimization can go deeper with more sophisticated design. A well-designed channel mix through big data reduces expensive resource utilisation. The digital channels are far more cost efficient as compared to brick and mortar, and other conventional structures.

Reduce administration and operation costs through automation:administration expenses are dramatically reduced by automating simple and repetitive tasks. Automation harnesses digital resources to re-engineer operations and the customer experience. All processes are leaned which frees talent from simple, repetitive tasks more appropriate for a machine. This removes the associated costs such as man hours and equipment, and even addresses hidden costs like errors which can be avoided through well developed technology. Automation not only trims fat, but also supports better integration of elements, which has an effect equal to removing excess.

Optimize IT spending through cloud technology and Agile development:Cloud technology and SaaS partnered with Agile technology manages not only software costs, but also hardware. Hardware needs are optimized through customized, low-demand IT. It is designed around business needs and eliminates the once costly hardware needed to support robust applications and systems. Cloud-based banks’ time to market is swift, and cost-income ratios are low because of lower hardware and software cost.

3. Challenges

Challenges are both internal and external. Internal is more the mindset and philosophy of the organization while the external could possibly be the business environment and/ or the regulatory framework.

Organizational silos:Customer data is typically owned by business lines, or distributed across specific systems that focus on specific functions. These business lines and systems also roll up to certain business units and geographies, therefore, banks normally lack a panoramic view of customer data. This problem is compounded in many banks that have legacy systems that don’t communicate with each other and can’t be integrated easily.

Lack of skilled professionals:Digital banking and predictive analytics, which require a completely new breed of data management, mathematical and statistical skills which has in turn fed the rise of the ‘data scientist’: a professional who not only understand analytics and it but also has the ability to communicate effectively with decision makers. However, these skills are in short supply, a problem compounded by the fact that most decision makers themselves have very little experience handling and analysing data.

Data not viewed as a strategic asset:Traditional approaches rely on a relational data model i.e. a model where one-one or one-many relationships are created inside an eco-system and then analyzed. However, the entire strength of predictive analytics, a major pillar of digitization, lies in its ability to create much more complex relationships. The other major difference between traditional data management techniques and predictive techniques is that traditionally, data has been viewed as static or historic, whereas predictive techniques treat data as a live and constantly evolving object. Organizations that don’t understand the power of predictive techniques take the traditional approach and consequently see lower returns.

Margin erosion: In traditional banking, high prices for services, interest, and various fees served as the major sources of revenue and consumers are tired of them. There have also been certain standards that exclude some segments of the population or simply hold little appeal. Digital banking offers opportunity for new entrants to addresses a newer segment by dropping these typical fees. They adopt and benefit from new technology and procedures with no concern for existing infrastructure like most banks. Such entrants not only appeal to marginalized unbanked / underbanked customers, but also digitally savvy banked customer. This quality of new entrant’s forces banks to slash prices to remain competitive.

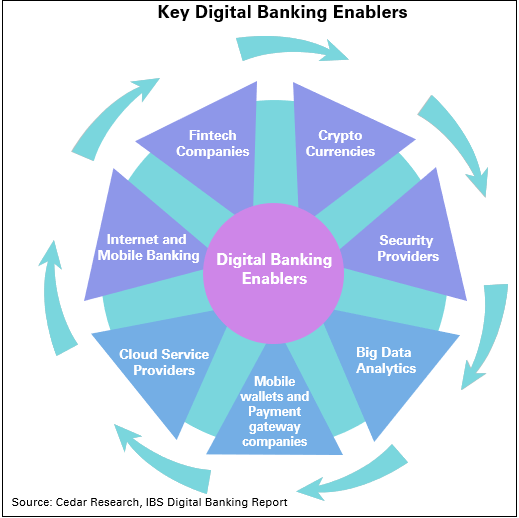

ENABLERS IN THE ECOSYSTEM

Digital Banking implementation is not a piecemeal activity. Rather, it is at the confluence of Technological innovation, evolution of banking needs, and changes in regulatory adoption. These three diverse forces are shaping the adoption and implementation of digital banking, which requires an ecosystem of ‘enablers’, to manage and facilitate its various building blocks

Smaller, tech savvy quasi banking entities that have been leaders in digital banking are known as FinTechs. These digital competitors are eager to take a larger share of the banking industry, and because they don’t have the traditional strengths of physical presence and massive capital base that traditional large banks have, they often rely on innovative digital features to gain wordof mouth appeal and win customers. Their features are designed to appeal to the millennial demographic and high net worth individuals, as this group wants fast access to services and is used to smartphones. The majority of retail banks believe that FinTechs and other new banks will be serious direct competitors by 2020. 56% of retail banks believe that alternative payment method providers such as Apple will also end up being serious competitors by 2020. These are the enablers of the digital ecosystem ( ref figure below).

TECHNOLOGY DEVELOPMENT

AROUND PAYMENTS,

WALLETS CRYPTO

CURRENCIES SUPPORTED BY

INFRASTRUCTURE SUCH AS

CLOUD SERVICE PROVIDERS

AND SECURITY TECHNOLOGIES

ARE ENABLING THE DIGITAL

ECOSYSTEM.

Also the following emerging trends are thought to represent the future of digital banking based on current evidence.

Wearable Devices:These have increased in popularity such as the Apple Watch, fitness watches, and other smartwatches. These devices represent another avenue of exposure for digital banking, and leading banks are already developing relevant app for smartwatch users. In 2015, 39.5 million adults used wearable devices with that number expected to grow to 63.7 million in 2016.

Biometric:As previously mentioned, biometric technology is increasingly being used in the financial sector for additional security. Fingerprint scanning ATMs and fingerprint tagged ID cards are two examples of this tech that are already in use. Latin America and Asia are two of the earliest adopters of this, and its use is expected to grow in regions where security is a main concern.

Banking App Stores:The recent growth of app usage has made it difficult for banks with mini-apps to organize and deploy them effectively among their users. Because of this, it is anticipated that a large number of the top 50 banks globally will be launching a banking app store in the immediate future.

Digital Payment Advisors (DPAs):DPAs encourage the use of alternate currencies like social currencies or loyalty points in order to purchase day to day products. Although it is not yet clear how financial institutions will implement DPAs, there exists an opportunity for managing or exchanging loyalty points or alternate currencies.

Gesture Recognition:: Gesture recognition in the financial sector is an evolving technology that involves using facial recognition sensors, and physical gesture sensors to interact with banking software. One software company is using a motion activated interface that is powered by Microsoft’s Kinect in order to manage accounts. Facial and voice recognition adds a layer of security.

FUTURE OUTLOOK

We are increasingly seeing the transition of banking from a predominantly transactional business to a customercentric one, where engaging customers through the most relevant channels has become important, both to maximize customer value as well as improve revenue streams. The concept of digitization or “digital banking” ranks high up the order as it aims to provide more personalized attention and customer services. It is also transforming the internal operations of banking through increased data access and real-time transmission and automation capabilities.

Digital platforms provide a unique opportunity to interact with customers on a regular basis in a more personalised manner. Since digital channels are generally consumed individually, this increases the scope for tailored customer experiences.

While banks have understood the significance of going “digital,” so far the changes they have brought about have not been too disruptive. The primary focus, for most banks, has been on enhancing the product offering with value added services and in implementing an integrated channel experience. The most prominent examples are mobile apps, e-wallet solutions. In particular, mobile banking have been well received by customers. This suggests that the focus has largely been on the outside, the customer facing side. Very few players have fundamentally changed their internal organizations and data set-ups. While it is not possible for many banks to invest to replace their legacy core banking systems any time soon, we do believe that achieving a digital and technology transformation will require continued investments.

Growth in digitization will also lead to new growth opportunities. There has been an increased need for banks to use the customer insights from banking transactions and a variety of other sources, such as social networks and shopping preferences, to better understand customer needs and align their marketing plans accordingly.

By using social networks, for example, they now have the means to access customers’ social profiles to build a deep insight of their overall behavior and product/service preferences.

BANKS HAVE NOW REALIZED

THAT DIGITIZATION

IS RESULTING IN A

CONVERGENT CUSTOMER

EXPERIENCE ACROSS MANY

INDUSTRIES (RETAIL, TRAVEL,

ENTERTAINMENT ETC.) AND

VALUABLE INSIGHTS ARE TO

BE FOUND ON CUSTOMER

PREFERENCES.

It is imperative banks not only react but also proactively design and implement their strategy in digital banking. In today’s environment, there is no digital strategy, there is only strategy in digital world.

Author | ASHISH DESAI

For a further conversation on this subject of Cedar View or how we may be able to help please email us at india@cedar-consulting.com